Exploring Features of Best ERP Accounting Module

ERP Accounting Module has become a popular choice of all businesses around the world to manage finance operations. It contains an integrated suite of applications that offer a variety of services from accounting or procurement to asset management and precise forecasting etc. Features of Best Enterprise Resource Planning system/software also includes client database, accounting system, financial analytics, integration and much more. Enterprise Resource Planning Software allows companies to manage their routine accounting matters efficiently, focuses on their business expansion and enhances productivity.

Why Do Businesses Need an Accounting Module?

Enterprise Resource Planning Accounting Module helps entrepreneurs to manage their accounting operations in a better way in order to take their business to the next level. When you integrate finance ERP Software with ERP System, this computer-based system simplifies the handling of tasks from inventory management to financial analytics. Additionally, Enterprise Resource Planning System is less costly than appointing highly-paid accountants therefore, many small businesses prefer to invest in Enterprise Resource Planning Software to complete their daily tasks such as expenses transactions, create invoices and much more.

ERP accounting module is used to collect data related to all financial operations in a business including cash flows, client database and more. It offers many features and tools that enable enterprises to handle their financial issues easily and increase their productivity by achieving accuracy. Moreover, the ERP financial module keeps entrepreneurs informed about the real-time situation of their business and they can access it from anywhere.

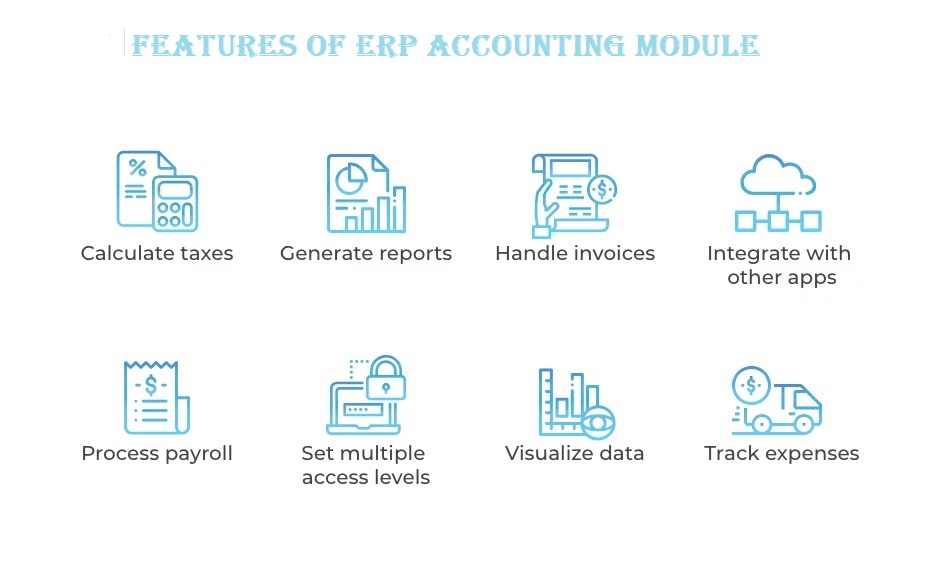

Features of ERP Accounting Modules

ERP Finance Module has complete functionality that your accounting department needs from maintaining balance sheets to profit and loss statements. Here are a few other important features of this module.

- Client Database: This module saves all the clients information in the database and administration can use this information such as balance sheets and financial transactions to ensure best customer service.

- Accounting System: These features allow companies to keep record of all revenue and expenses related financial operations. When all reports are prepared automatically, there will be no burden of paperwork as well as no chances of mistakes.

- Asset Management: You can better manage the cash inflow and monitor assets to analyze profit and loss in your business.

- Financial Analytics: Companies can see and track the real-time status of their receivables and payables. You can use this data while making business decisions.

- Forecasting & Prediction: This feature enables businesses to determine their financial plans by predicting future revenues and expenses. This can be done by keeping current state of company and financial reports in mind. In this way, you can also create and approve budgets for better outcomes.

- Integration: These accounting modules have the functionality to integrate with other modules and applications therefore, they offer data sharing between them.

- Payroll Tracking: You can access real-time data of payroll to get information regarding employee time, attendance and other matters.

In a nutshell, entrepreneurs can ensure better customer service and increase their turnover by leveraging ERP Accounting Modules to run their financial operations. To get more information about the ERP Finance Module, consult CherryBerry professionals today.