Payroll Management Tips for Small Businesses

Payroll management has a vital role in the success of small as well as large businesses. It ensures timely salary payments in order to comply with legal requirements. In this blog, we will talk about the top five payroll management tips that can enhance small businesses. In addition to this, you will also find the benefits of this system.

Understand Payroll Management

Payroll management includes the administration of employees, and compensation, including salaries, bonuses, wages, and deductions. It has many legal requirements to ensure the better performance of employees. If payroll is processed timely, it will maintain employees’ morale, foster productive work, and meet legal obligations.

Establishing an Efficient Payroll System

1- Setting up a Payroll Schedule

A well-planned payroll schedule is crucial to provide timely payments and to avoid delays in payments. So there should be consistency in payroll processing, data submission, and pay disbursements.

2- Implementing Automated Payroll Software

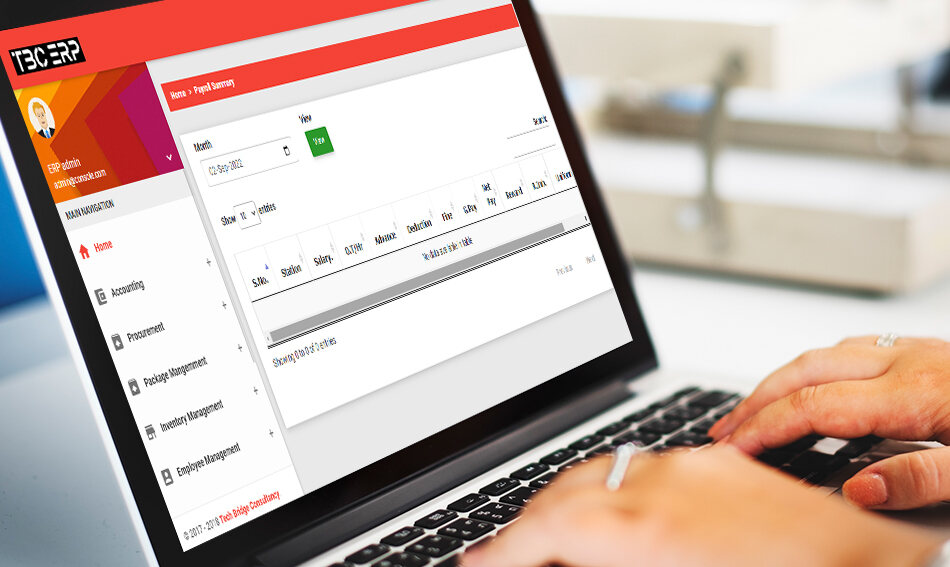

No doubt technology has a vital role in simplifying payroll processes. An automated payroll software like ERP can automate all the tasks such as calculations, compliance, deductions, and taxes. In this way, business efficiency will increase.

3- Ensuring Data Accuracy

Accuracy is the key feature of payroll management. There should be a robust data verification system that can measure all the records of employee data, salary, and tax deductions.

Calculating and Managing Employee Salary

1- Understanding the Components of Salary

Employee salary has various components such as basic pay, overtime, bonuses, and benefits. There should be a complete understanding of these components to provide accurate calculations.

2- Handling Additional Payments

Some employees are eligible for additional payments such as bonuses, overtime, or any other. There should be accurate calculations of these salaries to comply with legal requirements.

Stay Up To date with Payroll Legislation

1- Importance of Keeping Track of Changes

Payroll legislation is prone to update and change. It is important to stay up to date with these changes to comply with the rules and regulations.

2- Review and Update the Payroll Process Regularly

It is obligatory for payroll managers to regularly review and update payroll processes to get the latest changes. The updating involves updating payroll processes, implementing new policies, and adjusting calculations.

3- Seeking Professional Advice

It is important to seek advice from payroll experts in order to get valuable support in navigating complex legislation.

Ensuring Data Security and Confidentiality

1- Implementing Robust Data Security

Payroll data contains all the personal information of the employees that must be kept secure from any anonymous person. It has all the social security numbers and bank account details. So robust data security is crucial to keep this information safe.

2- Restricting Access to Payroll Data

Payroll data should be restricted from all unauthorized users and only the authorized ones can access it. It will reduce the risk of data breaches.

3- Regularly Backing up Payroll Data

If you regularly back up your data and store it safely, it will reduce the risk of data losses. Because data can be lost due to hardware failures or other reasons.

Streamline Payroll Processes

1- Automating Important Tasks

Payroll software can automate the most time-consuming tasks such as calculations, tax deductions, and generating pay slips. This automation can save much time for employees to do other important tasks.

2- Integrating Payroll Software

If you integrate payroll software with other HR systems such as time and attendance systems, it will streamline all the processes and reduce manual errors too.

3- Evaluating Payroll Process

Small businesses should regularly evaluate the payroll process to avail opportunities for optimization. This streamlines the workflow and helps the business grow.

Conclusion

For the success of every small business, an effective payroll management system should be established. By implementing all the mentioned tips, you can maintain legal compliance. ERP payroll management system is a powerful tool to streamline processes, reduce errors, and enhance the efficiency of your business. In this way, you can establish financial well-being and the satisfaction of the employees.